What is Santa Monica’s state-mandated housing unit

requirement?

By Marc L. Verville

There is ongoing confusion about how many units of housing Santa Monica is obligated to build to meet the State of California mandate. Is it the stated 8,895 units? Or is it actually more than 30,000 units? The answer is … both. This has been understood at City Hall since at least 2019, but members of the community and candidates for City Council continue to debate which number is accurate.

The confusion is understandable. While the State’s Regional Housing Needs Allocation (RHNA) to Santa Monica is 8,895 units, the actual number of units Santa Monica must build to achieve that target is an outcome of the mix of various subsidy types that are used to meet the State mandated number of 6,168 affordable units. Affordable housing is also known as belowmarket-rate housing, commonly referred to as BMR.

Based on the BMR project subsidy financing mix, as of November 2023, the total estimated number of units required to be built in Santa Monica so that our City can meet its state requirements for 6,168 BMR units was between 30,085 and 33,176 total new units.

The difference between the 8,895 allocated RHNA units and the 33,176 total units would be 24,281 market rate units.

Understanding STATED vs EFFECTIVE Santa Monica RHNA Unit Requirement

The stated RHNA unit allocation represents the minimum number of units that need to be built in Santa Monica at each income level and in total. The actual number that must be built to achieve those income-level targets depends on the extent to which BMR unit construction is subsidized by the developers’ market rate projects.

Developers effectively subsidize the provision of BMR units by including them as a subset of their profitable market rate units. This actual built BMR subset is generally within a range between 10% to 20% of a market rate development’s total unit size. This form of indirect subsidy is called “inclusionary” development.

The benefit to the State and cities of using this inclusionary approach is twofold:

1. It requires no state or municipal financial commitment since it is accomplished entirely through zoning and land use laws.

2. It completely obscures from public view the actual scale of development, deflecting local scrutiny, analysis, and potential opposition.

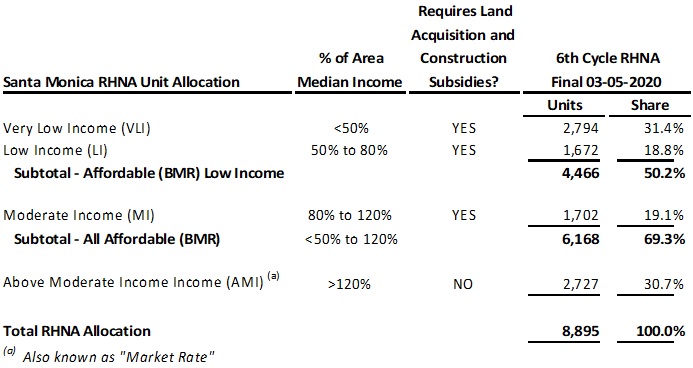

Santa Monica’s current 6th Cycle RHNA stated (or nominal) allocation is 8,895 units. Of that total, the BMR requirement is 6,168 units. This represents an implicit state mandated “inclusionary rate” of 69%. As Table 1 indicates, within the BMR requirement are further income-level targets.

Table 1: Breakdown of Santa Monica’s 6th Cycle Allocation

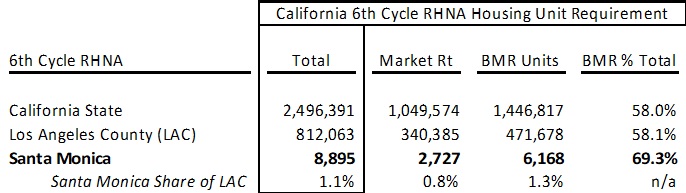

It should be noted that Santa Monica has a far higher proportion of allocated BMR units than the state and county averages as shown in Table 2 below.

Table 2: California 6th Cycle RHNA Housing Allocation Overview Santa Monica RHNA Unit Allocation

Subsidy Alternatives: Direct and Inclusionary BMR Construction Subsidies

Development economics are such that there are generally only two general project types employed to produce BMR units:

• 100% BMR projects using Direct Subsidies

• Inclusionary BMR units using the Indirect Subsidies of inclusion within market rate developments.

The City’s STATED and EFFECTIVE RHNA requirements would be the same ONLY IF there were sufficient Direct Subsidies available to fully fund construction of the 6,168 BMR units.

Using a 2019 estimate of an actual Santa Monica project’s construction-only costs (1), total estimated construction cost of the BMR unit allocation to Santa Monica would be around $3.8 billion at $661k per unit. This would increase to the $4+ billion range (plus inflation) if private land acquisition costs are included. The recent construction cost estimate for the Parking Structure 3 project reached the $1 million per unit level.

How much of California’s BMR target is covered by subsidies? What’s Santa Monica’s status?

An estimate of the cumulative amount of Direct Subsidies available from the major Federal and State subsidy programs (2) available to California overall, and the local jurisdictions within it, during the eight-year 6th Cycle RHNA period ranges from 3% and 7% of the allocated BMR unit construction cost (excluding land acquisition costs). The range reflects differing shares of each project financed by subsidies. Assuming the higher 7% construction cost coverage, and adequate local subsidy resources, Santa Monica could have been expected to fully fund 432 of its 6,168 BMR units in 100% BMR projects. Even if the City were to win more than its proportional share of subsidy financing, the potential scale of coverage compared to the state allocation is not meaningful.

Consequently, Santa Monica, like almost all cities in California, must rely on the Indirect Subsidies from an Inclusionary BMR production strategy. This strategy will always produce units in excess of the RHNA allocations. Of course, those “excess” units are always entirely market rate.

There is a theory that unlimited construction of luxury market rate units produces a chain of events (a “vacancy chain” or a “migration chain”) that ends up creating more affordable housing. This assertion was debunked by the Harvard Joint Center For Housing Studies in their May 2024 review of residential vacancy chains (12)

Santa Monica’s Progress Status as of November 2023

The December 19, 2023 City Council meeting included a status report on the city’s RHNA progress (3). Approved BMR units totaled 1,081 units. The pro-rata RHNA allocation share would have required around 1,542 units to have been approved. So, the City was 30% behind in its required progress.

While the report indicated that the City still had 5,075 units, 82% of the RHNA requirement, to complete, its entire market rate housing requirement of 2,727 units through 2029 had already been exceeded by 75% (4,773 units) (3) . Overproduction of market rate units against RHNA allocations in Santa Monica has been the norm for at least the last 20 years. In the prior (5th) RHNA cycle, Santa Monica produced 297% of its market rate allocation.

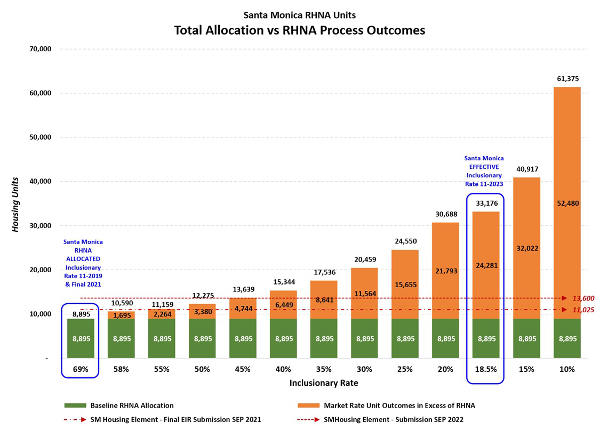

This snapshot indicated that the city was producing BMR units at an inclusionary rate of 18.5%. The 18.5% rate reflects the average of both 100% affordable projects as well as inclusionary projects that include between 10% and roughly 20% BMR units. This compares to the RHNA allocated Inclusionary Rate of 69%. The gap between the 18.5% actual inclusionary rate and the State-allocated 69% inclusionary rate is what produces the market rate units in excess of the RHNA allocation.

If that rate held for the remainder of the 6th Cycle (through 10-15-2029), and if as a result the city met its 6,168 BMR target, the total units produced would be 33,176. This would represent a 63% increase over the City’s housing unit inventory at the beginning of the 6th Cycle of 52,269 units as noted in the City’s Housing Element (4). The Housing Element is the City’sofficial housing plan submission to the State.

The Market Rate Units in Excess of RHNA are Essentially Invisible to the Process

While these extra market rate units can be seen along our boulevards, they are largely invisible in the administrative process, by state design. The State-approved understated impact of theadopted RHNA targets essentially eliminates City incentives to address the financial,environmental and community risks in its policy deliberation, formulation, and implementation. It should be noted that the benefit to the state and the city of lowballing the development impact is that the housing element can be approved at much lower densities than the RHNA process actually requires, avoiding open scrutiny and accountability.

In accordance with state laws, the City’s Housing Element Environmental Impact Report (EIR) and the Housing Element submissions do include additional “buffer” units above the RHNA allocations. These “buffer” units are calculated as a percentage of the base RHNA allocation. They are entirely unrelated to the full outcome of Inclusionary Strategy.

As the Figure 1 illustrates, the 2021 Housing Element EIR included 11,025 units while the final 2022 Housing Element included 13,600 units. The 11,025-unit EIR submission represented a 56% Inclusionary Rate while the 13,600-unit Housing Element represented a 45% Inclusionary Rate. As noted previously, the actual built BMR units generally fall within a range between 10% to 20% of a total development unit size.

Figure 1: Impact of Inclusionary Rate on Total RHNA Unit Production Requirements

The 30,000-unit impact was well known by the City in 2019 during 6th Cycle deliberations

The potential 30,000-unit outcome were known and discussed in the December 10, 2019 City Council Housing Study session. In the meeting, then Mayor Kevin McKeown remarked…

“So do the math. If we need to get 6,000 inclusionary or 6,000 affordable units, we do it through the inclusionary route, and the inclusionary is about 20%, that means to get 6,000 affordable units we have to allow 30,000 units at market rate to get built.” (5)

It was also noted in the meeting by former Mayor Denny Zane that the BMR targets could not be achieved regionally, and by implication in Santa Monica, without…

“…significant public money and or public land, both actually…”. (6)

Multiple City Risks

Despite anecdotal Council acknowledgement of the general scale of potential development and insufficient State subsidies, there was neither a staff analysis of these issues nor was there any direction to staff to produce such analyses.

Consequently, the city acquiesced to the state’s RHNA allocation without an understanding of the unprecedented demands on City financial and natural resources a 63% increase in residential units would create. In addition, there was no City analysis on the impacts of awholesale policy to dispose of public land that is dedicated to city-revenue generating commercial infrastructure. In 2019, business-related commerce supported 54% of the General Fund’s revenues.

In adopting this policy, the City chose to enact policies that simultaneously reduce City revenue-generating capacity with increasing cost-generating uses. It is the worst-case City financial scenario imaginable.

Ironically, the only analysis that was included in the 2019 staff report (13) consisted of a consultant’s appraisal of what types of project configurations would be economically feasible for developers.

Statewide RHNA failure

Santa Monica’s RHNA challenges are not unique. The fact is that most, if not all, California jurisdictions will fail to meet their 6th Cycle RHNA requirements. These failures will become evident in the state-mandated reporting in June of 2026 and June of 2027.

The average allocated inclusionary rate of around 60% is economically impossible to achieve. And the latest legislation (SB 423) allows developments to include BMR units at rates as low as 10% (7) . Available direct subsidies are wholly insufficient, as noted above.

This impending statewide failure is driven by the completely discretionary nature of the RHNA allocation process. While private development is entirely based on economics, the economically baseless RHNA process has been described by HCD consultants as“…(1) ad-hoc, rather than model-based; (2) reliant on simple rules of thumb; and (3) moderate in the exercise of administrative discretion.” (8)

The ad hoc and discretionary nature of the RHNA process was on full display in the October to November 2019 drafting period when Santa Monica’s allocation increased by 88% in a roughly 3-week period, from 4,829 to 9,058 units. This huge change was executed on the basis of Abundant Housing LA lobbying of the state allocating agency during October of that year. The Santa Monica shift was part of a 154,000-unit pivot executed in that same 3-week period to move unit allocations from the inland areas to the denser coastal areas. These city-altering changes were implemented in a state process that is supposedly carefully managed over a roughly 2-year period. This was also known by the Council in its December 10, 2019 housing study session.

City policy implementation on autopilot

During the December 10, 2019 Council meeting, the 30,000-unit outcome was irreverently treated as a distant hypothetical outcome. No data was presented to Council about either the reality of attainable subsidies, the future City revenue loss of implementing a city-owned commercial infrastructure dismantling program, or the impact of radically increasing the costgenerating residential base. And, in making that uninformed and uncritical decision to accept the economically baseless 6th Cycle RHNA allocation in 2019, that Council has significantly tied the hands of the current and future councils. It also directly led the to the Builders Remedy issues when the current council attempted to ameliorate the most damaging outcomes of the resulting Housing Element submission.

Despite the fact that these policy actions strike at the core of city financial and environmental viability, there is still no analysis of whether, and how much, affordable housing (and the related market rate housing unit volume inflation) the city can afford. This program has now become a reality by default, with the City’s implementation on autopilot.

What choices does Santa Monica have?

That Santa Monica will fail to meet their 6th Cycle requirements was anticipated by former Mayor Zane back in 2019 (9). This is a very different decision-making context than the unsupported assumption that, somehow, the RHNA requirements will be fulfilled at reasonable cost.

So, Santa Monica and other charter cities have options. The City must now weigh the costs of RHNA unit production shortfalls with the escalating, permanently rising, and potentially debilitating costs of chasing an unachievable, economically baseless, and arbitrarily determined, state mandate. The current path places all the city’s amenities and programs in the General Fund at risk of gradual reduction and potential elimination in the long term as ongoing cost escalation from densification far exceeds revenue growth as the business base erodes from city-owned commercial infrastructure decimation.

So, the question needs to be asked about what would the costs of a RHNA unit production shortfall be? From a review of the September 24 City staff report (10), the “Builders Remedy” and other penalties cited relate to an out-of-compliance Housing Element. But…Santa Monica has a compliant and California HCD-approved Housing Element. (14)

So, it seems that the relevant failure scenario would be the shortfall in actual permitting performance against a compliant Housing Element. In Santa Monica’s case, the shortfall would be in the delivery of sufficient BMR housing to meet the RHNA allocation since the city has already exceeded its market rate allocation. The penalty for unit delivery shortfalls under SB35 and SB 423 are the ministerial approval of development projects with a minimum of 10% or 50% affordable units.

But since 50% BMR projects are financially unsustainable without subsidies, they suffer from the same issue that is preventing the city from reaching its RHNA BMR allocation. The city is currently having to approve 10% projects, so the incremental cost to the cost of not meeting the BMR allocations may be minimal to non-existent as against the long-term financial debilitation of the irreversible conversion to housing of city land used for commercial infrastructure.

The issues discussed above result from RHNA units are being determined on a regional (i.e. the “R” in RHNA) basis and then being subjectively allocated by city. That is how Santa Monica’s draft allocation was able to increase 88% in a 3-week period in 2019. The recently passed SB7 doubles down on this methodology by mandating allocations without regard to local limitations of finance, resources (e.g. water), or zoning.

What is to be done?

The bottom line is that the city’s core responsibility is to its residents and its local businesses that create the city’s revenues (which ultimately support resident services and amenities). The city’s responsibility includes vigorously defending its long-term financial viability. It should:

1. Place an immediate freeze on all declarations of “surplus” city land that is commercial infrastructure

2. Immediately direct staff, it’s consultants (or both) to produce a fact-based analysis of the impacts to the city’s financial and environmental viability with the current development trends.

3. Immediately direct staff to include a holistic and fully completed short-term and long-term financial assessment of all the City revenue streams that would be impacted by the disposal of commercial infrastructure such as parking lots PRIOR to any Councill deliberation or decision (see the staff report on the surplus declaration of Parking Structure 3 for how not to approach the issues (11))

4. Assess the real penalties for delivery shortfalls, not housing element compliance, which has already been achieved.

5. Prepare for hard negotiation with the state on the 7th Cycle allocations that will come into effect in November 2029 using the analyses and data above. This must include a legal strategy in collaboration with other similarly situated charter cities,

There are legal approaches with RHNA as well available to charter cities. If the state is going to preempt local, municipal authority or local control over a municipal issue of a charter city, the law has to be narrowly tailored to the least intrusive method. RHNA laws are not narrowly tailored. In fact, they apparently were not even written for charter cities. They were written for general law cities.

If these options are not vigorously pursued to reset the city on a path of planned and sustainable development, then the long-term city’s financial viability, environmental stability, and overall livability, will become unsustainable.

The alternative? Service and amenity cutbacks, and / or direct taxation of the residents once commercial revenue generation falls hopelessly behind city cost growth.

Editor's note: Marc L. Verville is a Sunset Park resident who is Chair of the City's Audit Subcommittee. The ideas expressed in this Opinion piece are his own.

References

(1) California Tax Credit Allocation Committee 09-25-2019 Pacific Landing | 2120 Lincoln Blvd (at Pacific Street)

(2) Programs surveyed include the Federal and CA State Low Income Housing Tax Credit (LIHTC) programs, California Multifamily Housing Program (MHP), California Affordable Housing and Sustainable Communities (AHSC) program, Permanent Local Housing Allocation (PLHA) program, and the Local Housing Trust Fund (LHTF) program.

(3) Santa Monica City Council (SMCC) 2023-12-19 Item 10.A. - Emergency IZO - Objective Design Standards for SB 35 Qualifying Projects; Figure 2 p5

(4) City of Santa Monica 2021 – 2029 Housing Element, Final Draft, September 2022 p5

(5) SMCC Meeting December 10, 2019 Item 4.A. – Study Session – Update on recent state and regional housing production efforts and preliminary findings from Affordable Housing Production Program feasibility testing

(6) Ibid: You Tube Timestamp 03:28:17

(7) SB 423 Senate Rules Committee: Office of Senate Floor Analyses 09-01-2023

(8) A Review of California’s Process for Determining, and Accommodating, Regional Housing Needs; Background paper prepared for the California State Auditor in relation to the audit ordered by the Joint Legislative Audit Committee on Oct. 11, 2021, p20.

• By Christopher S. Elmendorf, Martin Luther King, Jr. Professor of Law - UC Davis School of Law; Nicholas J. Marantz, Associate Professor of Urban Planning & Public Policy - UC Irvine School of Social Ecology; Paavo Monkkonen, Associate Professor of Urban Planning & Public Policy UCLA Luskin School of Public Affairs

(9) SMCC Meeting December 10, 2019: Item 4.A. – Study Session – Update on recent state and regional housing production efforts and preliminary findings from Affordable Housing Production Program feasibility testing

(10) SMCC September 24, 2024 - Agenda Item 12.A. Introduction for First Reading and Adoption of an Ordinance Amending Text of the Zoning Ordinance for Phase 2 Implementation of the 6th Cycle (2021-2029) Housing Element – Staff Report

(11) SMCC Meeting 2021-03-23 Item 8.A. - Parking Structure 3 Surplus Declaration p5 Financial impact summarized as: “There is no immediate financial impact or budget action necessary as a result of the recommended action. When staff returns to Council for interim or long-term disposition proposals, the specific financial impacts for each property will be shared.”

(12) Suburban Housing and Urban Affordability: Evidence From Residential Vacancy Chains By Robert French and Valentine Gilbert | Harvard Joint Center for Housing Studies 04-30-2024

and the Harvard Kennedy School 05-02-2024

(13) SMCC Meeting December 10, 2019 Item 4.A. – Study Session – Update on recent state and regional housing production efforts and preliminary findings from Affordable Housing Production Program feasibility testing – Attachment A: HR&A AHPP Financial Feasibility Results 11.13.2019

(14) City of Santa Monica 6th Cycle (2021-2029) Adopted Housing Element - HCD Approval 10-14-2022